(ABOUT CREDIT AND CREDIT SCORES)

Like a birth mark, each one of us has been tagged with a distinctive numbered marking called credit score! It is a tag that stays with us forever.

But unlike the real static birthmarks, this distinctive numbered tag called credit score is dynamic and changes over time. It depends entirely on our own individual credit histories (or how we manage our credit). Every time we apply for credit, like making a car loan, or a personal loan from a bank, or apply for a mortgage or a new credit card, lenders look mainly on our credit scores to determine the level of credit risks they will have to take with each of us before making their credit decisions.

What is a credit score?

Whether we like it or not, our credit history is being reported to and stored by three major credit reporting agencies in the United States (Equifax, Experian, and Transunion). Lenders who have extended credit to us provide these reporting agencies with details of our credit history such as the type of credit we’ve used, the length of time our account has been open, and whether or not we have paid our bills or not. These are incorporated into individual credit reports which also include information on how much credit we’ve used and other pertinent information like if we are applying for new credit sources.

In making credit decisions, lenders buy these reports from the three credit reporting agencies. However, based only on these credit reports, the credit granting process by lenders were quite slow, inconsistent, and oftentimes biased; up until the Fico Score (more popularly known as credit score) was invented.

Using data from our credit history (as provided by the three credit reporting agencies, which in turn is based on data provided by our lenders), a company called Fair Isaac Corporation (FICO) developed an objective scoring system using advanced math and analytics. The new scoring system allowed for faster credit decision making by lenders, in fact it now only takes seconds for credit decisions to arrive on line. The new system took away personal biases and opinions and made credit decision making fair and objective. On top of these, the new credit scoring system allows our past credit problems to fade away in time especially with the entry of new data showing improved payment patterns. These Fico Scores are now the most widely used credit

scoring system worldwide.

scoring system worldwide.The FICO® score is calculated by a mathematical equation that evaluates many types of information from our credit report in any of the three credit reporting agencies. By comparing this information to the patterns in hundreds of thousands of past credit reports, the FICO score estimates our level of future credit risk. Our level of future credit risk is then calculated and expressed as a number which ranges from 300 to 850 where the higher the score means the lower the credit risk and vice versa. However, while many lenders use the Fico scores to help them make their lending decisions, there is no set cut-off range or score for all of them. Each lender has his own strategy and sets his own cut off score based on the level of risk it finds suitable for his own credit product.

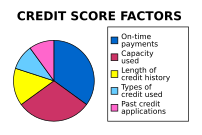

Here is the breakdown of how Fico score assesses the data from our credit report:

· Payment History - 35%

· Amounts Owed - 30%

· Length of Credit History - 15%

· Types of Credit in Use - 10%

· New Credit - 10%

Please note that while Fico scores considers only the data contained in our credit reports, lenders may want to also consider other information before making the final lending decisions. The additional information may include our household income, the length of time we have worked at our jobs and the type of credit we are applying for.

It is important to regularly manage our credit health well and maintain a high Fico score at all times because the benefits are enormous such as getting better credit offers, lower rates of interests, and speedy credit approvals. So, if we are planning to make a major purchase such as buying a car on installment, or applying for a mortgage on a new home, it is best to check on our credit scores six months earlier to give us enough time to take actions to improve our Fico scores.

We’ve been scored and there’s nothing we can do about that but to maintain a healthy credit status!

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=186cc0fa-b86a-47ff-883d-558d35d57b86)

No comments:

Post a Comment